How to Record Withdrawals in Quickbooks

Steps for Recording the Expenses in the QuickBooks Account. Withdrawals from the company bank account.

I Would Like To Enter My Banking Transactions Manually But It Is Wanting To Export The Information How Do I Bypass This

Go to the Banking menu.

. Turn on the Auto match record setting. Here are few steps mentioned which can assist the users to record the owners withdraw in QuickBooks. After this you need to choose the appropriate bank account.

Click on the Banking at the top menu bar. To record owners investment and withdrawal of cash in QuickBooks desktop you would us the same QuickBooks windows that you record normal income deposits an. If you have decided to record them in QuickBooks be sure to enter two bank transactions.

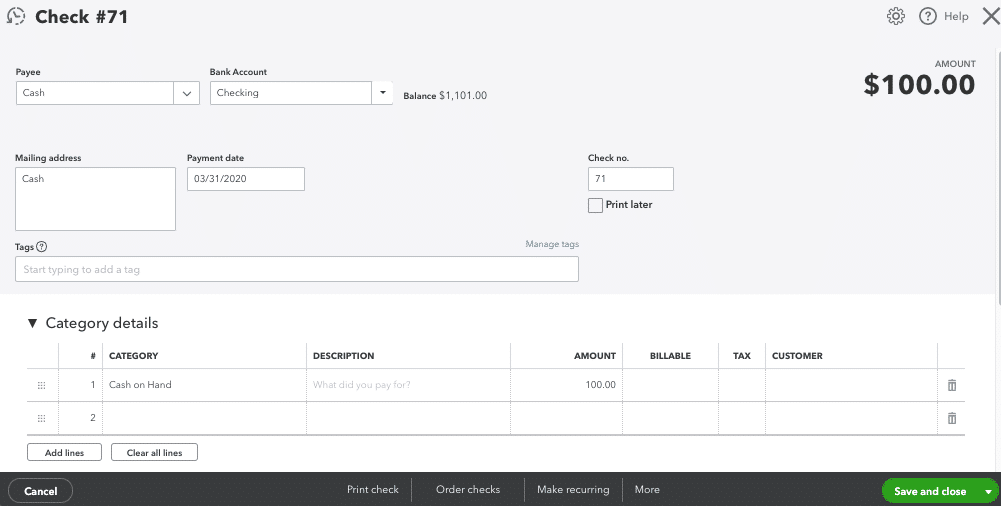

Then you need to choose to Write Checks. Hello Agof To record a cash withdrawal for business purposes from a business account you can create an expense You can do this you would click on symbolexpenseselect the bank account the cash was withdrawn fromfill in the date and amountyou would need to select an expense accountessentially what you are withdrawing the case for Any questions. Click the Account button below and select New.

Select the Lists menu and choose Chart of Accounts from the. Go to the Recorded tab. Choose and enter.

Select Record Merchant Service Deposits. If you want to exclude downloaded bank data heres how. Choose Bank as the account type.

Petty Cash or Cash Bank Account. Create Owners Draw Account. Go to the For Review tab.

QuickBooks And QuickBooks Online make it very easy to record ATM. Complete the rest of the details as required. Sometimes these owner withdrawals are for non-.

Open a deposit slip and on a blank line enter the following. When you get your monthly bank statement heres how you can review the payments in QuickBooks Desktop. Click on the Equity and press continue.

In this QuickBooks Online Training tutorial you will learn how to record transactions where the owner invests cash or withdraws cash to or from the business. For the Deposit entry use the make deposits function. Next is to hit the New button at the bottom left and select Account.

Enter your preferred Account Name Example. Select a Payee in the pay to the order of the field. Go to Lists and choose Chart of Accounts.

Click the Account button select New and choose the Bank radio button to allow your. The Received From column can be left blank. Then go to the Chart of Accounts or for shortcut press CTRL A on your keyboard.

Select the appropriate bank account to deposit to and the correct date. Steps to Creating the Owners Draw Account. Apply the custom filter the date and check no.

These amounts should be from the deposit and withdrawal to offset and not cause any discrepancies on your books. The first step is to run the QuickBooks and click on the banking menu. Firstly you need to choose the Lists tabs.

On the left navigation bar click Banking. How to Record in QuickBooks When an Owner Withdraws Cash from the Business Account Create Petty Cash Account. Hit the Write Checks option in the Bank Account given option select the business account which needs to be withdrawn.

Select Change your deposit settings. Heres how to create a Petty Cash Account or Cash Bank Account in QuickBooks. Click on Banking then select Record Merchant Service Deposits.

Solved How To Record Cash Withdrawals In Qb 2019

Connect And Review Your Banking In Quickbooks Onli

Solved How To Record Cash Withdrawals In Qb 2019

How To Handle Petty Cash In Quickbooks Retain Transaction Data

No comments for "How to Record Withdrawals in Quickbooks"

Post a Comment